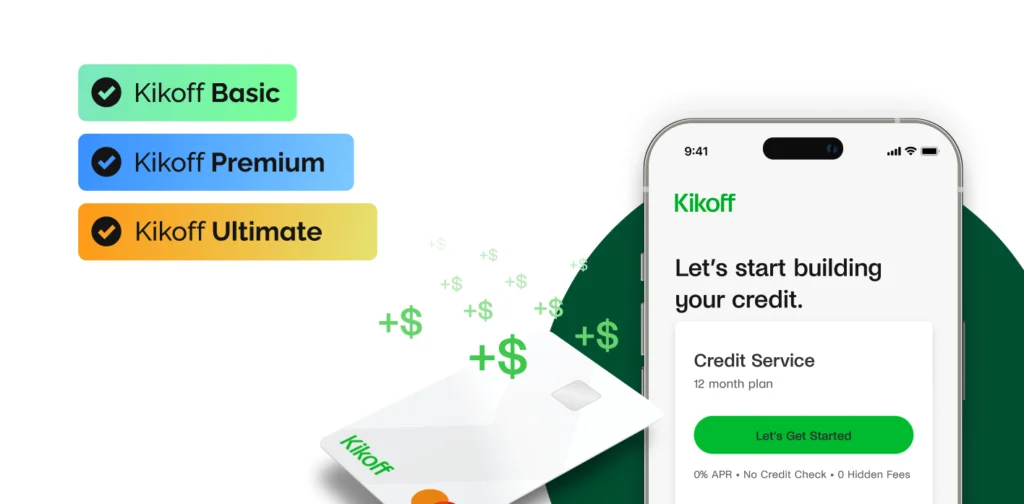

If you are someone who does not have a credit score, the Kikoff Credit Card is the best thing for you. It is designed for people who are just getting started, so building good credit is no more complicated a process. Therefore, without any delay, you must apply for Kikoff credit card.

Kikoff credit card is a credit card that comes with low or zero fees and also doesn’t have any strict criteria. It means you can easily get it without worrying much. The main purpose of the Kikoff is to help people build or improve their credit. If you are someone who wants to improve their credit, you must get it.

As a first-time user, it is very normal to get confused about how to apply for it. Thus, here we have discussed the eligibility criteria and the steps by which you can get it without any hassle.

Eligibility Criteria to Apply for Kikoff Credit Card

The following are the basic eligibility criteria to apply for Kikoff credit card:

- Must have a Kikoff Premium or Ultimate subscription

- No credit check is needed to apply

- Must be at least 18 years old

- Must have a valid Social Security Number (SSN) or Tax Identification Number (TIN)

- Need a valid residential address

- Make a minimum deposit of $50

Also, read How to Apply for CIMB Credit Card

How to Apply for Kikoff Credit Card?

If you are interested in applying for Kikoff credit card, there are two different ways:

- Kikoff User Dashboard

- The Secured Credit Card application portal

Remember, both methods can be followed with the help of the website and the app.

How to Apply For Kikoff Credit Card via Kikoff User Dashboard?

To apply for Kikoff credit card through the Kikoff user dashboard, you will need to decide whether you want to use the app or the official website.

Official Website

The first thing that you need to do is to log in to your Kikoff account via the website and follow the steps below:

- Go to your user dashboard.

- Tap on the “Secured Card” tab.

- Follow the on-screen instructions to submit your application. In the application, you will have to enter personal information like your name, address, date of birth, and other details for verification.

- Click “Submit” to successfully apply for Kikoff Credit Card.

Official App

The first thing is to get the app on your device. Once you have downloaded it, log in with your account and follow the similar steps mentioned for the official website method.

How to Apply for Kikoff Credit Card Via the Secured Credit Card Application Portal?

Just like the Kikoff user dashboard method, if you want to apply for the card through the Secured Credit Card Application Portal, you will again have to decide from where you want to apply for the card. Once selected, you will have to perform similar steps on both the app and the website.

- Visit the application portal for the Kikoff Secured Credit Card linked on both, Kikoff website and app.

- Enter your login credentials.

- Now look for a section labeled “Secured Card” or “Apply for Secured Credit Card” on the dashboard.

- Tap on it and you will get the application form.

- Enter the required details like your name and email address to apply for the card.

Also, read How to Apply for Amex Credit Card

Conclusion

Kikoff Credit Card is the card offered by Kikoff Company to help people build their credit. It comes with lower costs. However, if you want to apply for Kikoff credit card, you can do it either through the Kikoff user dashboard or the Secured Credit Card application portal available on both the website and the app.

To apply, you will have to choose one of the methods and log in with your account. Once done, tap on “Secured Card” available on the dashboard and provide the important details, and submit the application form. You will get the confirmation email. Wait for a few days to receive the card. Please note that the card is only available for Kikoff Premium or Ultimate subscription members.

FAQs

1. Can I Withdraw Money from Kikoff Credit?

Yes, you can easily withdraw money from your Kikoff credit card just like you do with normal Debit cards.

2. How Long Does it Take to Get a Kikoff Card?

You will get the physical credit card within 10 working days.

3. Can I Use Kikoff to Pay Bills?

No, you cannot directly use Kikoff to pay your bills, as it only helps you to build credit.